Supporting Our Communities Through Financial Education Programs

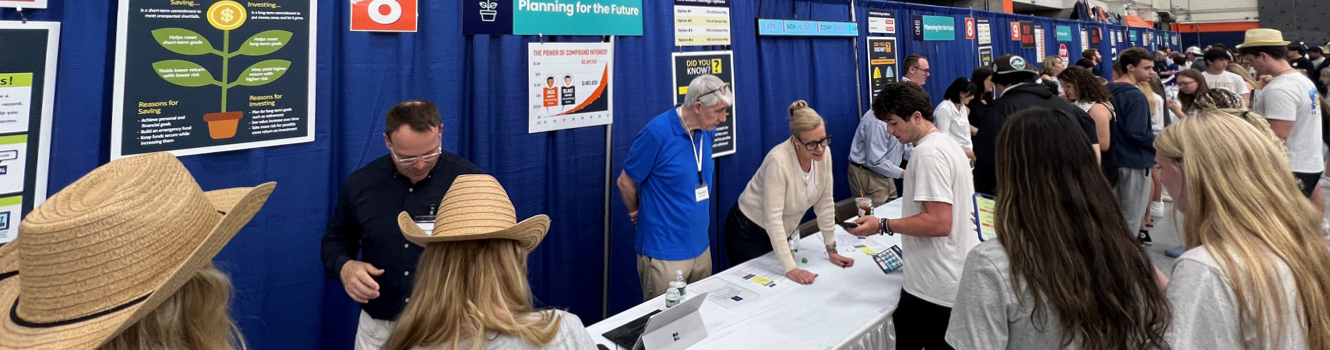

The Credit for Life Fair is an interactive event held at high schools and colleges across Massachusetts and beyond and hosted by financial institutions and other organizations. The goal of Credit for Life is to prepare students to survive financially in the everyday world before they leave high school. Students choose professions, assume the roles of 25-year old 'professionals with paychecks' and use their monthly ‘salaries’, ‘credit cards’ and ‘savings accounts’ to purchase everything they will need to live as adults. The goal of the day: to balance their budget and not overspend.

Institution for Savings has been hosting Credit for Life Fairs for more than fifteen years. 2025 highlights included:

- 15th Annual North Shore High Schools Credit for Life Fair hosted 1,100+ students from Amesbury, Newburyport, Pentucket, Triton, Ipswich, Georgetown, Landmark, Masconomet, Salem, Beverly, Gloucester, Swampscott and Rockport.

- 2nd Credit for Life with Lynn Public Schools hosted 750 students from Lynn Classical and Lynn English High Schools; Lynn Vocational Technical Institute; Frederick Douglass Collegiate Academy; and Harold Durgin Success Academy.

- Credit for Life Fair at Essex North Shore Agricultural & Technical School

- The Bank partnered with Salem State University (SSU) to host 'Budget like a Boss: Credit for Life Fair' for incoming SSU students this past September at the Ellison Campus Center.

Looking for more information about Credit for Life or to volunteer? Contact us and/or watch our info video.

Every fall and spring, Bank representatives visit high schools in the Bank's market area to talk to seniors about the importance of careful budgeting, maintaining good credit and the perils of bad credit. The goal is to help young adults develop a stronger understanding of credit and how to use it responsibly before they leave high school. Email us if you are interested in learning more.

Every fall and spring, Bank representatives visit high schools in the Bank's market area to talk to seniors about the importance of careful budgeting, maintaining good credit and the perils of bad credit. The goal is to help young adults develop a stronger understanding of credit and how to use it responsibly before they leave high school. Email us if you are interested in learning more. Good money habits start early! Our "Be A Smart Saver" initiative is a spin-off of Teach Children to Save, a national program that helps young people develop lifelong savings habits at an early age. Each spring, our employees visit area elementary schools to teach young students about the importance of saving money.

Good money habits start early! Our "Be A Smart Saver" initiative is a spin-off of Teach Children to Save, a national program that helps young people develop lifelong savings habits at an early age. Each spring, our employees visit area elementary schools to teach young students about the importance of saving money. Buying your first home can be daunting....and that is why we are here to help you navigate the journey and explain all the mortgage options available. You'll be able to make informed choices and find the mortgage that fits your budget and lifestyle through our First-Time Homebuyer program.

Buying your first home can be daunting....and that is why we are here to help you navigate the journey and explain all the mortgage options available. You'll be able to make informed choices and find the mortgage that fits your budget and lifestyle through our First-Time Homebuyer program.We have also partnered with the local First-time Homebuyer Education providers listed below to offer an additional closing cost credit of the standard course fee when you complete one of their courses. Simply provide the course completion certificate and proof of payment to receive the added benefit at closing.

- Qualifying and applying for a home mortgage

- Working with realtors, home inspectors and closing attorneys

- Purchasing homeowners insurance

- Special issues surrounding condominiums and multifamily homes

Contact a homeownership advisor directly at 978-281-4770 x110

or via email at abeaton@ghama.com.

Identity theft occurs when a criminal deliberately uses someone else’s personal identifying information to obtain financial gain, make purchases, obtain credit or loans, or gain other benefits in another person’s name, often at the other person’s loss or disadvantage.

Identity theft occurs when a criminal deliberately uses someone else’s personal identifying information to obtain financial gain, make purchases, obtain credit or loans, or gain other benefits in another person’s name, often at the other person’s loss or disadvantage.