April is National Financial Literacy Month and financial wellness is at the heart of our mission.

YOUTH & FAMILIES

Why talking to children about money is so important.

Studies show that by age 3 children can grasp basic money concepts and by age 7, many have already formed money habits! That’s why starting to have conversations about finances at a young age is an important part of helping children develop a healthy understanding of - and relationship with money.

Tips!

- Include your children in daily life discussions related to money, like paying bills or sticking to a budget when you go to the grocery store.

- Strive to use positive language. For example – rather than “we can’t afford it” – try: “Great idea! Let’s start saving!”

- Share your experiences to help them further understand how you got to where you are today! This helps deepen the understanding and importance of the value of money.

As FitMoney shares, "Financial habits are formed by age 7 - and financial literacy is just that: a habit. Personal finance isn't a skill like addition or multiplication, it's a learned behavior that takes time to develop." Check out FitMoney's family resources to help guide your family financial learning.

As part of the Institution for Savings’ “Be a Smart Saver” program, we have created “Money Talks” conversation cards for elementary students to keep these important conversations going. We will be visiting area elementary schools this spring!

PROTECTING YOUR MONEY

Grandparent Scam

Hingham victim recently lost $9,500 to this shameful scam

The “Grandparent Scam” preys upon older adults who are tricked into thinking they are “helping” a grandchild or family member who claims to be in trouble. Scammers create fake storylines use fear tactics and extreme scenarios to obtain funds illegally, knowing that grandparents would do anything to help loved ones such as wiring money from their bank accounts.

The “Grandparent Scam” preys upon older adults who are tricked into thinking they are “helping” a grandchild or family member who claims to be in trouble. Scammers create fake storylines use fear tactics and extreme scenarios to obtain funds illegally, knowing that grandparents would do anything to help loved ones such as wiring money from their bank accounts.

Some common scenarios:

- They often know a grandchild’s name and pretend they are that person.

- They use technology to display your grandchild’s name on your caller ID.

- They may use emotion to disguise their voice.

- They plead for you to wire money and ask you not to tell family members.

The FTC reports that grandparent scams are getting more prevalent and sophisticated, but reporting it when it happens can be a helpful step towards prevention. Recently, a 77-year-old woman from Hingham lost $9,500 and almost $5,000 more to this shameful scam. Read this recent story to stay informed and aware of scenarios happening here and across the country.

Prevention Tips:

- Create a family “safe" word or phrase that only you and your loved ones would know. If you get a suspicious call, say, “Okay, first, tell me our family word/phrase."

- Watch for hints of irregularities. Did they call you “Grandma” when it’s always “Nana?”

- When in doubt, tell them you need a number to call them right back, then call that family member directly. If you can’t reach them, try a loved one or a friend.

Visit American Bankers Association’s “Safe Banking for Seniors” website for more information about this and many other scams.

Each April, the Bank hosts a FREE Community Shred Day.

For many aspiring homebuyers, the mortgage process can seem daunting. Are there different types of mortgages and what's the best one for me? How much can I afford? How much do I need for a down payment?

To prepare you for the process we developed this Mortgage Explainer featuring a Know-Before-You-Mortgage checklist for anyone in the market for a mortgage. Being knowledgeable and prepared for one of the most important financial decisions of your life is half the battle. Read our Explainer and reach out with any questions! We are here to help!

YOUTH & FAMILIES

Books to Teach Your Kids About Money

It’s never too early to start teaching your kids about money - and it can be fun! Check out these children’s books to help teach your kids money basics such as saving vs. spending, wants vs. needs, and much more:

It’s never too early to start teaching your kids about money - and it can be fun! Check out these children’s books to help teach your kids money basics such as saving vs. spending, wants vs. needs, and much more:

- Bunny Money by Rosemary Wells (3-5 years)

- A Boy, a Budget, and a Dream by Jasmine Paul

(4-8 years) - The Four Money Bears by Mac Gardner, CFP (3-7 years)

- The Berenstain Bears, Trouble with Money by Stan and Jan Berenstain (3-7 years)

- One Cent, Two Cents, Old Cent, New Cent: All About Money by Bonnie Worth (4-8 years)

- A Bike Like Sergio’s by Maribeth Boelts (5-8 years)

- Rock, Brock, and the Savings Shock by Sheila Bair (4-8 years)

- Lemonade in Winter: A Book About Two Kids Counting Money by Emily Jenkins (3-7 years)

More book recommendations:

MANAGING YOUR MONEY

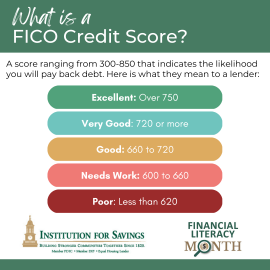

Take Charge of Your Credit Score

Credit is one of those things that can seem great at first, but it can quickly get out of control if you are unsure how to manage it. The biggest misconception about credit is that it is a bad thing. Instead of running away from credit, it is smarter to develop good credit habits early and use those habits to enhance your financial life.

Credit is one of those things that can seem great at first, but it can quickly get out of control if you are unsure how to manage it. The biggest misconception about credit is that it is a bad thing. Instead of running away from credit, it is smarter to develop good credit habits early and use those habits to enhance your financial life.

PROTECTING YOUR MONEY

#SafeBankingForSeniors: Protecting Seniors from Financial Exploitation

Are you related to, caring for or a senior citizen yourself? The U.S. Securities and Exchange Commission defines elder financial exploitation as “exploitation of an older person by another person or entity, that occurs in any setting (e.g. home, community, or facility), either in a relationship where there is an expectation of trust and/or when an older person is targeted based on age or disability.” It is a serious and troubling crime and knowing what it is along with some tips to recognize and avoid it is very important.

Read our Financial Exploitation of Seniors blog post for signs of potential exploitation, and steps to protect yourself and your money. Our Security page also highlights current scams that we are seeing in the community and is updated regularly.

YOUTH & FAMILIES

FitMoney’s '$uper$quad': Free Online Financial Literacy Program for Kids

By teaching children about money early, it can equip them with the knowledge and skills they need to manage their money effectively and build behaviors that will lead to a healthy financial future.

By teaching children about money early, it can equip them with the knowledge and skills they need to manage their money effectively and build behaviors that will lead to a healthy financial future.

We are partnering with FitMoney to offer its $uperSquad program, a game-based curriculum for K-6 youth that utilizes fun and educational videos, games, and choose-your-own-adventure stories. The program is designed to be used by parents/guardians with their children.

Watch this short video to see how it works!

In recent weeks, financial institutions across the country have seen an alarming increase in check fraud related to mail. Criminals are breaking into the large blue US post office mailboxes along with residential mailboxes, stealing and searching the mail for checks. Among the types of check fraud are:

- Check Washing - chemicals are used, including basic nail polish remover, to remove information from a check including the payee and amount. Fraudsters deposit these altered checks into a different account other than the intended one and for a higher amount of money.

- Counterfeiting - checks are created that are nearly identical to the original check, with the stolen signature duplicated.

- Forgery – signing a check without authorization or endorsing a check not payable to the endorser.

- Enroll in online banking and check your account daily for any discrepancies. When possible, click on the check image to confirm that no changes have been made to your original check. If you see any discrepancies, call us immediately at 978-462-3106. You may be liable for losses if you delay reporting any anomalies to us.

- Consider enrolling in Bill Pay and making your payments electronically rather than mailing paper checks.

- If you do write a check, use gel ink. It can be more difficult for thieves to “wash” those checks cleanly.